With the steady growth of the insurance industry, insurance agents are in high demand, and recruiting insurance agents can be a challenge. Though it can be tempting to fill open positions quickly, it’s important to make sure that you’re getting the right people for your team.

CareerPlug has helped thousands of insurance agencies grow their teams and we’re sharing our best advice for recruiting insurance agents, along with the valuable advice of some industry experts.

First, we’ll cover what makes hiring in the insurance industry unique, then go over what to look for in an agent and recruiting tips that can help you win over top candidates.

The state of hiring in the insurance industry

Every industry has its own unique set of challenges, and the insurance industry is no different. CareerPlug’s Client Education and Retention Lead, James Saunders, has advised many insurance clients on hiring best practices over the years. He’s seen a few key distinctions that make hiring for insurance agents more difficult than hiring in other fields:

- Required licensing is unique to each state and each insurance type.

- Independent insurance agents or “producers” are largely commissioned positions.

- The license is bestowed to and independently held by the producers who work for your agency/company (they do not rely on your organization to keep their license).

- Most viable insurance candidates can’t be successfully recruited with the same tactics as unlicensed/less-specialized workers.

These are important factors to consider when recruiting insurance agents. The high demand for agents has also impacted the ability of insurance employers to make all the necessary hires for their teams. During the pandemic, insurance professionals were one of the least-impacted employment demographics, with a majority (69%) of insurance professionals saying their workload was the same as or greater than before the pandemic.

While the demand for insurance agents has stayed steady, the volume of available candidates has fluctuated, making hiring challenging for employers. (This is something the insurance industry has in common with many other industries!)

The best time to hire insurance agents

In our own research, we found that January and February saw the highest percentage of applicants for the insurance industry. Applicant volume took a sharp dip in April and May, but stabilized again beginning in June. November and December also brought more applicants than average.

See key recruiting metrics from the insurance industry

To hire insurance agents for your team, it can be helpful to stay up to date on industry trends such as the best time of the year to hire and other recruiting metrics. We analyzed some industry data for you that can help you improve your hiring process.

DOWNLOAD MY REPORTWhat to look for in an insurance agent

There are certain skills and qualifications that insurance agents need to have. What exactly you are looking for in candidates may depend on the size of your business and the resources you have available for guidance and training.

As Saunders points out, “Insurance employers often desire pre-licensed candidates. When comparing smaller agencies to larger corporate entities, employers have varying degrees of preparedness and resources to offer training/guidance.”

“While it’s often inexpensive to get licensed, it requires study and preparation. Until someone is licensed, they cannot produce for an agent. Some employers can be reluctant to pay even the base wage of an unlicensed new hire because they are unable to grow the business right away. Plus, there is nothing to stop a base-wage-supported new hire from getting licensed and then leaving for another agency that has better base pay, benefits, and lead generation.”

Creating an ideal candidate profile beyond the license

First, you’ll likely need to decide if licensure is or isn’t a deal breaker for you. But you’ll also want to think about the other qualities you want your candidates to have. Are you looking for someone with a sales background? Or maybe you’re open to recruiting recent college grads?

Think about qualifications and experience as well as soft skills like adaptability, the ability to communicate well, and time management. Some other important qualities of insurance agents according to Investopedia are: people skills, personality, persistence, and reliance.

Another trick to help you identify the right candidate for your business specifically: Think about all of the best agents you’ve worked with in the past – what are some of the qualities that made them great?

Product knowledge is also important, but a candidate with the right soft skills can be trained on the technical aspects of the job. By evaluating candidates for soft skills, motivation, and trajectory, you can hire for growth potential. Giving someone a chance often helps you earn a high performing, loyal employee.

We recommend getting clear on the kind of candidate(s) you are looking for and writing it all down in an Ideal Candidate Profile. This will make it easier to evaluate applicants as they come in and speed up your hiring process. To learn more about creating an Ideal Candidate Profile, watch this video from CareerPlug’s Senior Director of People, Natalie Morgan:

Tips for recruiting insurance agents

Once you have a better idea of the kind of candidates you are looking for, it’s time to start recruiting! But in the competitive insurance industry, it’s important to take active steps toward building out a great recruitment process and creating a positive candidate experience if you want the best candidates to say yes to your job offers.

Prequalify candidates to save time

In our Insurance Industry Recruiting Metrics Report, we found that insurance employers have a very high applicant-to-interview ratio, but a very low interview-to-hire ratio. This could suggest that insurance employers are frequently inviting unqualified candidates to interview.

You can make sure that only the most qualified candidates are making it to interviews by including pre-screen questions on your application. If you’ve decided that you only wanted licensed applicants, you can include this as a question to weed out the rest. You might ask applicants whether they are comfortable with cold calls or what experience they have working directly with clients.

A few important questions early on can save you a lot of time in the hiring process, and ensure that the applicants you do end up reviewing meet your bare minimum requirements.

Always be hiring

We recommend passive recruiting to all of our clients, but this is even more important for recruiting insurance agents.

Saunders says, “Licensed insurance professionals rarely face an imminent or unexpected need for employment. They rely on personal and professional networks to provide new opportunities but often are ‘passive candidates’ – i.e., not unemployed, not necessarily dissatisfied in their current position, but still open to new opportunities. This means that qualified agents are more likely to have their path crossed by an employer than to actively be looking for new work.”

Passive recruiting will help you reach those top candidates that aren’t necessarily looking for a job and it can save you from being in a difficult position of rushing to fill an unexpected vacancy.

State Farm Agent Heather Thies emphasized the importance of CareerPlug’s philosophy: always be hiring. “I have learned that even if you don’t have an opening at this very minute, it is critical to always be recruiting and interviewing. If you wait until you lose an employee to start your search, it’s often too late,” she says.

Diversify applicant sources

To reach more insurance agents, it’s a good idea not to solely rely on job boards to get your company in front of the right people.

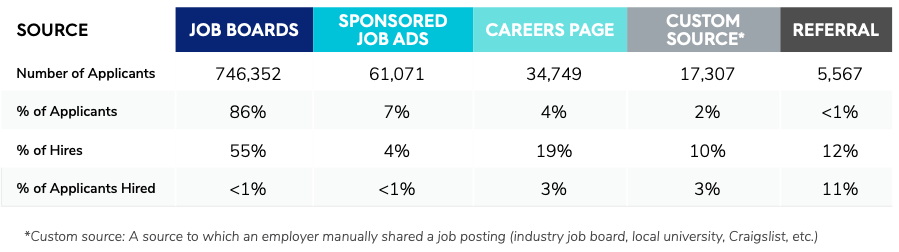

For our insurance industry clients, job boards produce a whopping 86% of applicants, but only bring in a little more than half (55%) of hires. Where are the rest coming from? First: company careers pages, which account for only 4% of applicants but 19% of hires, are a high-quality applicant source for insurance businesses.

Your company’s careers page serves as the hub of your employer brand. Candidates use it to learn about your company and get a sense of what it’s like to work for you. A strong careers page helps to compel job seekers to apply, and job seekers that do apply from a company’s careers pages are often more invested, since they’ve taken the time to research your company.

Check out this video from our Senior Director of People, Natalie Morgan on building a compelling careers page to host your open jobs:

Next, referrals brought in less than 1% of applicants, but 12% of hires, and custom sources brought in just 2% of applicants, but 10% of hires. Your current team members and even clients can be a great resource for insurance agent leads. Let your network know you’re hiring and ask for referrals. You could also post your job to custom sources like industry specific or local college job boards.

Don’t be afraid to step outside the box and get creative. Doug Miller, a State Farm Agent in Indianapolis, had success with an unconventional strategy. He says, “I did a video a few months ago saying ‘I’m hiring!’ and put it on social media. I got the best response I have ever gotten. It worked incredibly well.”

Offer the right benefits

No matter your industry, one thing is certain – if you want to hire the best candidates, benefits are important! In fact, we found that 25% of job seekers want to learn about a company’s benefits before applying. So not only do you need to offer competitive benefits, you also need to lead with them in your job postings.

In our own research, we’ve found that “more opportunities for growth” was one of the most sought after benefits in every industry. Let potential agents know what the path for growth looks like at your company and highlight any employee development initiatives you might offer.

Another unique opportunity in this industry is offering a bonus to unlicensed candidates to retroactively pay for insurance licensing (materials, exams, fees) after someone becomes licensed and has been producing for a few months.

More benefits that people care about?

- Paid time off

- Health insurance

- Flexible work schedules

- Family leave

Sean Black, a State Farm Agent in Berwick, Pennsylvania, has found success by offering more enticing benefits. He says, “I’ve increased my base pay and I’m now offering health insurance, so I’m attracting a little better candidate pool this time around.”

Use text recruiting to hire faster

With competition so high for top talent, the faster you can respond to qualified candidates, the better your chances of making a hire. Text recruiting can help you reach more applicants sooner and get your interviews scheduled faster.

Emails are easily lost amongst your candidate’s full inboxes, so it’s not totally surprising that email has only a 20% open rate. Compare that to text messages which have a 98% open rate. The average email gets a response about 6% of the time compared with the average text message, which has a 45% response rate.

One insurance client that uses text recruiting through CareerPlug had this to say:

Simplify Insurance Recruiting with an Applicant Tracking System

Whether you’re hiring one insurance agent or many, having a fast and easy hiring process is key. You can complete every step of your hiring process in an ATS like CareerPlug, from job posting to job offer.

LEARN MORE